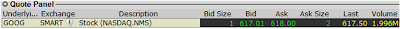

Below is an example of simple quotes which are often associated with stock quotations. The bid is what someone is willing to buy the stock at and the ask is what someone is offering to sell their stock at... the difference between them is called a bid-ask spread. The Last column indicates the last price agreement, where stocks were traded, and volume is how many shares have been traded so far.

There are also the bid size and ask size which shows the number of shares (in 100s) at the price shown.... so here the highest price someone is willing to pay for GOOG at the moment is

$617.01 and they have 100 shares to sell. Similarly, someone else (or a collection of people) are willing to buy at $618, there are 200 shares willing to be traded at that price.

The quotes are similar to the car example from yesterday's post, however, here you only see the best prices, but not really what others are willing to pay or offer..... so you don't know who else is buying or selling cars - how many or how much. Below is a Level II quote monitor:

The left column is the bid, the right is the ask. These are all a list of people waiting to buy or sell their stocks at specific prices. You can click on the image to enlarge and see the text better.

So you can see in the bid column, there is someone waiting to buy 100 shares at $617, BUT the next one after that is at $616.58, and someone or collection of people waiting to buy 1100 shares at $616.50. Similarly in the ask side.

This information is very helpful and in a way gives you an in-depth look at what's driving the market... basically a look at supply and demand info!! You can see that all it takes is for someone to be willing to sell 400 shares of GOOG at market for the price to reach $616.55 from the current $617.50 last traded price!! Ever heard of anyone saying that big players can move the market with their orders? That's what it means - if someone all of a sudden dumped a large number of shares, it could drive the price of the stock down, same is true for driving the price up with market buy orders.

BTW, Level II quotes are not free and brokerages usually charge a monthly fee for allowing access to this data.

No comments:

Post a Comment